Сад мечты своими руками - От проекта до воплощения

- Интересные рецепты, как сохранить вешенки на зиму

- Эскапел и задержка месячных: почему нет менструации?

- Готовим жареные крабовые палочки Крабовые палочки обжаренные в яйце

- The Superstitions in Britain

- Стих я вас любил Бродский я вас любил

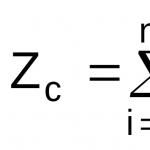

- Суммарный показатель загрязнения почвы

- Кристаллы и кристаллография Как называется кристаллы

- Государственные языки литвы

- Молчановский лес. Мончаловский лес

- Морские обитатели и интересные факты о них

- Салат селедка под шубой Сельдь под шубой с шампиньонами без свеклы

- Рецепты приготовления судака с фото

- Запеканка с картошкой и мясом в духовке рецепт

- Топ великих русских, которые русскими не были

- Неопределенный артикль A \ AN в английском языке

- Как найти иероглиф, который вы не знаете?

- Как приготовить гуся, чтобы мясо было мягким и сочным?

- Плыть толкование сонника

- Красный Мюрат: история Семена Буденного Борис вадимович соколов буденный красный мюрат

- Политолог Валерий Соловей: "Путин изберется и уйдет по ельцинскому сценарию через два-три года"

- Лекции Андрея Борисовича Зубова

- Нужна ли запятая перед "как"?

- Как появились беглые гласные Слова с беглой гласной е в суффиксе

- Статусы про возраст Статусы про то как человек взрослеет

- Омар хайям цитаты о любви и вине

- Арабская магия Основные принципы Магии Хаоса

- Блюда из замороженных ягод

- Фз 27 статья 11 пункт 2.2. О направлении разъяснений по представлению ежемесячной отчетности. Глава iv. заключительные положения

- Бланк ф 26.2 2 образец заполнения. Уведомление о переходе на УСН — образец заполнения. Образец заполнения заявление о переходе на УСН

- Как его приготовить в домашних условиях по рецепту и без него

- Рулет с маком и орехами из слоеного теста

- Плов из булгура — очень сочный и рассыпчатый!

- Поступление в медицинский вуз

- Обучении в центре онлайн образования фоксфорд

- Рабочие факультеты (рабфаки) Смотреть что такое "рабфак" в других словарях

- Компьютерная игра для автоматизации звука ш в начале слова Логопедические задания на звук ш и ж

- Регресс по осаго Регресс в страховании разница схема

- Теория вероятностей - Вентцель Е

- Лекции по психосоматике (Николаева В

- Презентация по музыке на тему "Психология музыкальной деятельности

Поделиться: